The billing document is similar to the

delivery document in that it has a header and item level, but no schedule line

level, as in the sales documents. Thus one must configure the header document

type and the relevant item categories.

To define the billing document type, use

the following menu path.

SAP Customizing Implementation Guide --> Sales and Distribution --> Billing--> Billing Documents --> Define Billing Types --> Define

Billing Types

You may maintain a billing document type or

create your own by copying and changing the billing type key. Remember when

creating your own document types to use the name range beginning with the

prefix of Z.

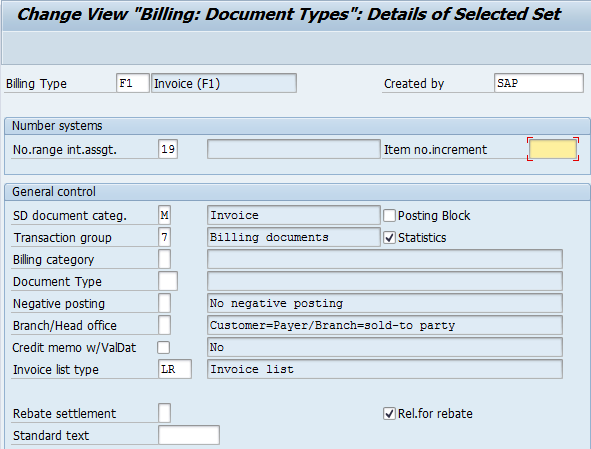

The header data of a billing document

defines how the document is to behave. It has the standard number range

assignments. However, note that the billing document only uses internal

assignments. It is not possible to have an external number range for a billing document.

The billing document is split up into control sections, which I’ll cover next.

The General Control Data

The general control data, shown in Figure,

includes the sales document category, which defines what type of document the

system is using. The SAP standard for invoice is M. (You will remember the

standard for a delivery is J, etc.)

- The posting block stops automatic release of the billing document to accounting. This means the billing document must be manually released to accounting by selecting Billing --> Change --> Release to Accounting from the billing document.

- The statistics checkbox indicates if this billing document is relevant for updating the information systems such as the sales information systems (SIS).

- One must also assign a transaction group 7 for billing documents and 8 for pro forma invoices.

- The billing category is a further sub-division of billing document type and transaction group. This category is used for selection of screen variants and classifications.

- The document type is used when the accounting document is created.

- The negative posting is only effective if the company code for which the posting is carried out permits negative postings. (In reality it is rarely used.)

- The branch/head office is important as it determines which customer master record is used to update the accounting documents. Generally, if the payer is different than the Sold-to Party, the payer is transferred to Financial Accounting as the customer.

- The credit memo with value data checkbox is used for credit memos, to set the baseline date as the date from the original billing document.

- The invoice list type represents the document type that may be used to create invoice lists for this billing document. You may also state that such a billing document is related to the rebate process by indicating what rebate type of document it is in the rebate settlement field.

No comments:

Post a Comment